Trusted Payroll Management Solutions-- Contact CFO Account & Services for Payroll Services

Trusted Payroll Management Solutions-- Contact CFO Account & Services for Payroll Services

Blog Article

Browsing the Intricacies of Pay-roll Solution: A Total Guide for Entrepreneurs

As business owners endeavor into the world of managing their businesses, the details of pay-roll services frequently present a maze of difficulties to browse. From understanding pay-roll tax obligations to guaranteeing conformity with wage laws, the journey can be overwhelming without a detailed overview. One error in taking care of payroll can cause pricey consequences for a burgeoning service. In this full guide tailored for business owners, we unwind the complexities of payroll services, using approaches and understandings to make and streamline processes notified choices. Join us on this trip to untangle the elaborate globe of pay-roll monitoring and encourage your organization for sustainable growth and success.

Comprehending Payroll Tax Obligations

Companies have to precisely determine and withhold the correct amount of taxes from staff members' incomes based upon factors such as revenue degree, filing standing, and any kind of allocations claimed on Type W-4. Additionally, services are in charge of matching and paying the suitable part of Social Safety and Medicare taxes for each staff member.

Recognizing payroll taxes includes staying updated with tax laws and laws, which can be complicated and subject to alter. Failure to adhere to pay-roll tax obligation requirements can cause expensive penalties and fines for companies. As a result, services must ensure they have the knowledge and processes in location to manage pay-roll taxes accurately and efficiently.

Selecting the Right Pay-roll System

Navigating payroll services for entrepreneurs, especially in understanding and managing payroll tax obligations, emphasizes the vital value of selecting the appropriate payroll system for effective financial operations. Choosing the ideal payroll system is essential for services to enhance their pay-roll procedures, make certain conformity with tax obligation laws, and keep precise monetary records. Entrepreneurs have several options when it comes to choosing a payroll system, varying from hand-operated approaches to advanced software remedies.

When picking a pay-roll system, business owners need to think about factors such as the dimension of their organization, the intricacy of their payroll needs, budget restraints, and the level of automation preferred. Little companies with simple payroll needs might go with standard payroll software or outsourced pay-roll solutions to handle their pay-roll tasks effectively. On the other hand, bigger ventures with more elaborate payroll structures might benefit from sophisticated payroll systems that supply functions like automated tax calculations, straight deposit capabilities, and combination with bookkeeping systems.

Ultimately, the key is to pick a payroll system that straightens with the service's particular needs, boosts operational performance, and makes certain timely and exact payroll handling. By selecting the best pay-roll system, entrepreneurs can effectively manage their pay-roll obligations and concentrate on expanding their companies.

Conformity With Wage Laws

Making certain compliance with wage regulations is a fundamental aspect of keeping legal stability and honest criteria in company procedures. Wage link regulations are developed to protect staff members' rights and make sure reasonable compensation for their job. As an entrepreneur, it you can look here is essential to remain educated about the certain wage legislations that apply to your company to prevent possible monetary charges and legal issues.

Key factors to consider for compliance with wage laws include adhering to minimal wage demands, accurately categorizing staff members as either exempt or non-exempt from overtime pay, and ensuring timely repayment of salaries. It is likewise important to keep up to day with any changes in wage laws at the federal, state, and regional degrees that might influence your organization.

To effectively navigate the complexities of wage legislations, think about executing payroll software program that can assist make sure and automate computations accuracy in wage payments. In addition, looking for advice from lawful specialists or human resources specialists can provide valuable understandings and assistance in preserving compliance with wage regulations. Contact CFO Account & Services for payroll services. By prioritizing conformity with wage regulations, entrepreneurs can create a structure of depend on and justness within their organizations

Improving Payroll Processes

Performance in managing payroll procedures is paramount for business owners seeking to optimize their company procedures and make certain accurate and prompt payment for employees. Simplifying pay-roll procedures entails carrying out techniques to streamline and automate tasks, inevitably saving time and lowering the danger of mistakes. One efficient means to improve pay-roll is by buying payroll software program that can streamline all payroll-related information, automate computations, and create reports flawlessly. By leveraging innovation, business owners can get rid of hands-on information access, enhance information precision, and ensure conformity with tax laws.

In addition, outsourcing payroll services to a trustworthy provider can further simplify the procedure by offloading jobs to experts that specialize in pay-roll administration, allowing business owners to concentrate on core organization tasks. By enhancing payroll procedures, business owners can improve effectiveness, accuracy, and conformity in managing staff member payment. Contact CFO Account & Services for payroll services.

Outsourcing Payroll Services

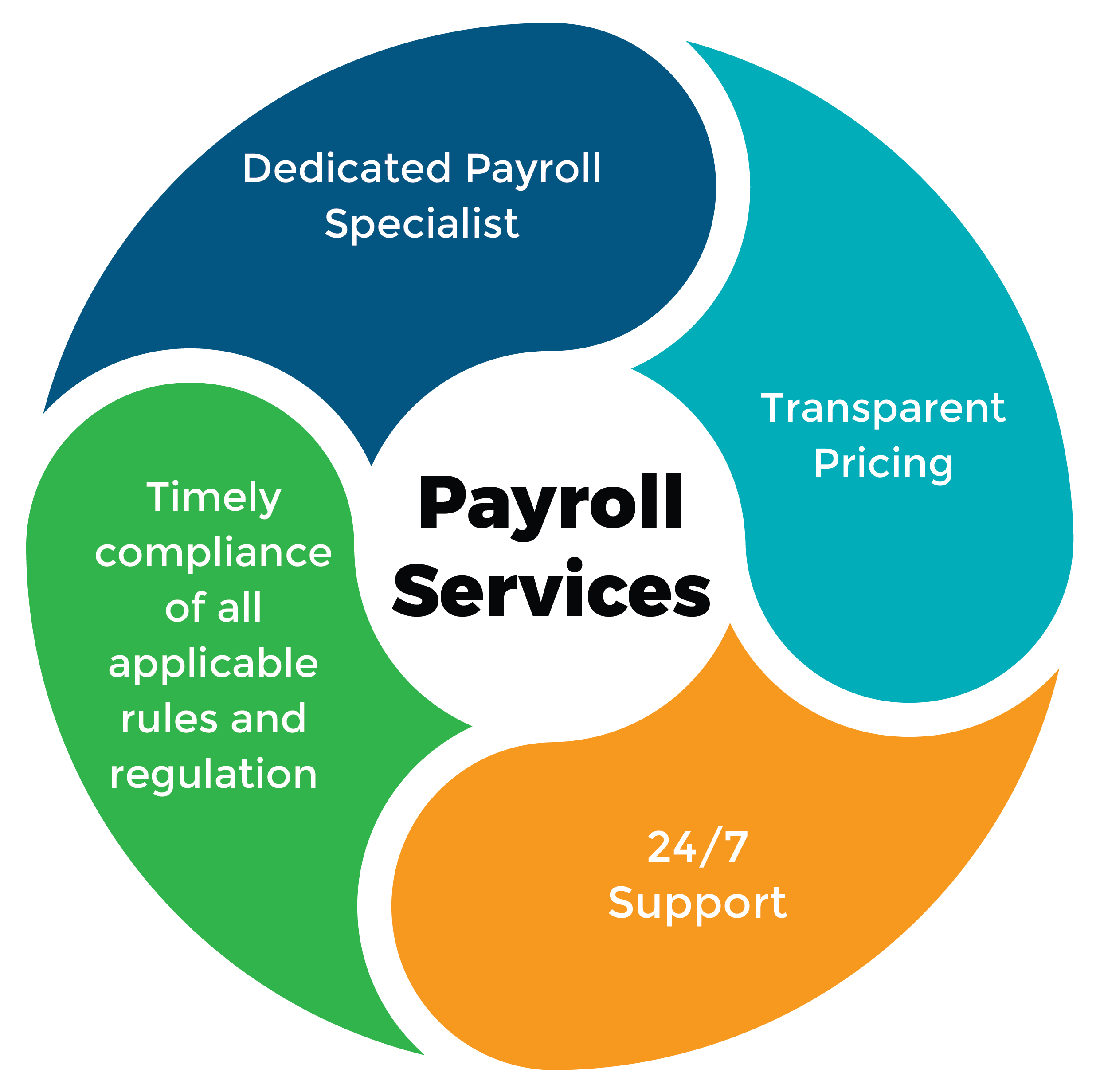

Taking into consideration the complexity and time-consuming nature of pay-roll management, lots of business owners choose to outsource payroll services Source to specialized providers. Outsourcing payroll services can provide countless benefits to organizations, including price savings, increased precision, compliance with tax obligation regulations, and releasing up valuable time for business owners to concentrate on core organization activities. By partnering with a trusted pay-roll provider, entrepreneurs can make sure that their staff members are paid accurately and in a timely manner, taxes are determined and submitted correctly, and pay-roll information is firmly managed.

Verdict

To conclude, browsing the complexities of payroll solution needs a thorough understanding of pay-roll taxes, selecting the appropriate system, sticking to wage legislations, optimizing processes, and possibly outsourcing solutions. Entrepreneurs have to meticulously take care of pay-roll to make sure compliance and performance in their service operations. By adhering to these guidelines, business owners can efficiently manage their payroll responsibilities and concentrate on expanding their company.

Report this page